The U.S. and Japan reached a truce that will allow most steel shipments from the Asian nation to enter tariff-free for the first time since 2018 and see the countries working together to combat Chinese trade practices that harm the industry.

Washington will suspend the 25% levy on incoming steel imports from Japan up to 1.25 million metric tons a year, officials from the Commerce Department and U.S. Trade Representative’s office told reporters Monday. Anything beyond that will still be subject to additional charges. The agreement will take effect on April 1, the officials said.

The U.S. imported about 1.7 million metric tons of steel from Japan in 2017, the most recent year not affected by the tariffs. Imports fell to 1.1 million tons by 2019, according to Commerce Department data.

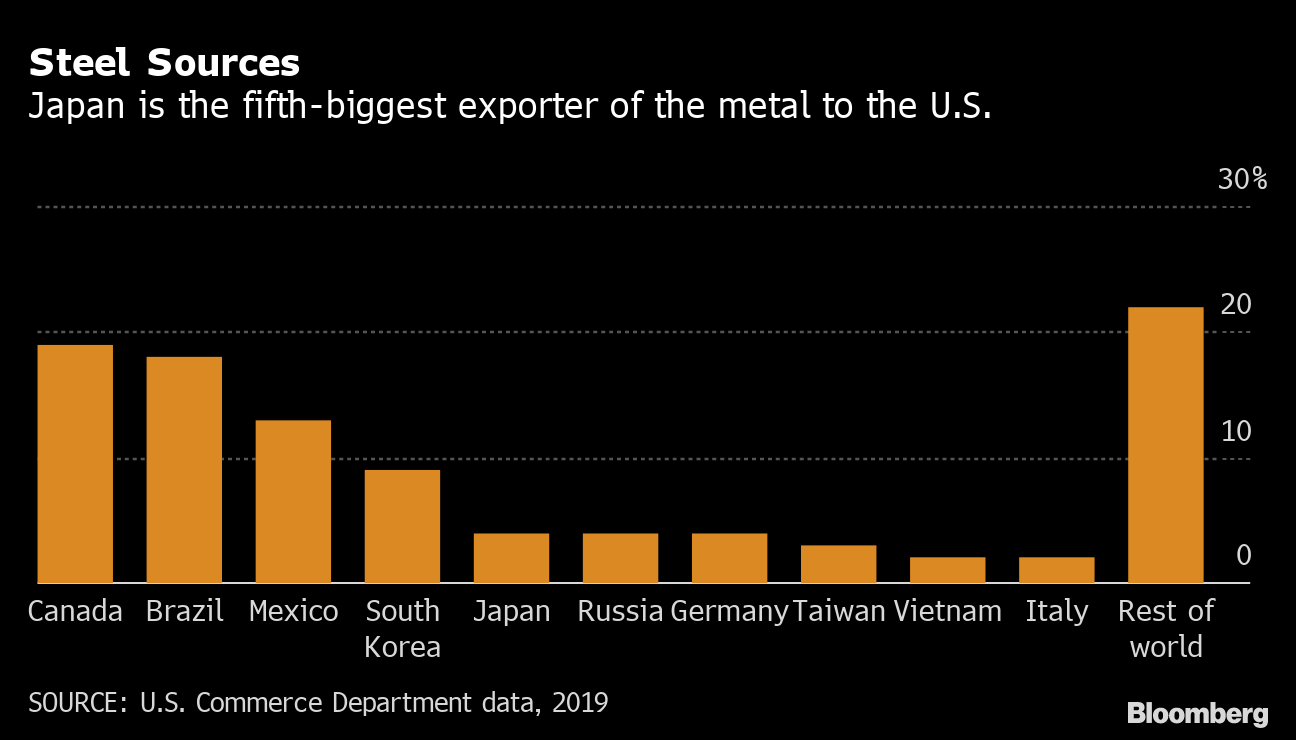

Japan is the fifth-biggest exporter of metal to the U.S.

The solution, which Bloomberg News reported earlier, mirrors the accord that the U.S. reached with the European Union in October that ended punitive measures on as much as $10 billion of each other’s goods.

“Today’s announcement builds on the deal we struck with the EU and will further help us rebuild relationships with our allies around the world as we work to fight against China’s unfair trade practices,” Commerce Secretary Gina Raimondo said in a statement.

Japan’s Trade Minister Koichi Hagiuda told reporters in Tokyo on Tuesday that the move was a step forward, but added: “We will continue to press the U.S. hard for a complete resolution.”

While the U.S. and EU are seeking to leverage their deal into a broader global arrangement to address non-market excess capacity and penalize countries that don’t meet low-carbon targets for steel and aluminum, Japan isn’t joining that process at this time, the officials said.

The U.S. and Japan instead will confer on potential domestic steps that the Asian nation can take, including methodologies for calculating steel and aluminum carbon intensity, the officials said. Japan wanted to focus the negotiations on steel, and thus the nation’s aluminum exports aren’t covered by Monday’s deal and will still face 10% tariffs, they said.

The metals dispute started in 2018, when Trump imposed duties on steel and aluminum from its biggest trading partners, including the EU and Japan, citing risks to national security. While the EU subsequently retaliated, targeting products including Harley-Davidson Inc. motorcycles, Levi Strauss & Co. jeans, and bourbon whiskey, Japan did not, focusing instead on negotiating a trade deal with the U.S. to cover some agricultural and industrial products.

U.S. Ambassador Rahm Emanuel said the agreement was spurred on by President Joe Biden’s virtual summit with Japanese Prime Minister Fumio Kishida last month, at which Biden pressed for urgency on the problem.

“As opposed to the last three years, this is a step forward in an affirmative way, together,” Emanuel said in a phone interview from Tokyo. “The U.S. is now turning its attention to another ally, Great Britain,” he added. “When we collectively stand up, that is a big, big statement.”

The metals tariffs on Japan remained when the Biden administration took office last year, and the U.S. made an offer to Japan to resolve the steel dispute in December, an official with knowledge of the talks said at the time. But Tokyo was holding out for a better deal and had wanted the tariffs to be abolished completely, the person said.

In terms of volume, Japan only accounts for about 4% of all steel imported to the U.S., and about 1% of all metal consumed in the U.S., based on Commerce Department data.

Still, it’s another domino falling for allied countries receiving exemptions to send steel duty-free to the U.S. market. That access makes domestic steel producers uneasy because they argue it creates a slippery slope that opens the door for those countries with exemptions to ramp up their exports.

U.S. steelmakers also warn that exempted nations can act as pass-through points for metal coming from bad actors like China. They worry that Europe, which recently received an exemption, and Japan could unknowingly import metal from restricted countries and then export that to the U.S., flooding the market.

All steel from Japan that will be subject to duty-free entry will need to be melted and poured in the nation, the U.S. officials said, a measure meant to block imports from other nations using Japan as merely a point of transit.

United Steelworkers, which represents 850,000 employees in industries including metals and mining, said the deal shows Biden “understands that we must move beyond the less-effective, one-size-fits-all approach of the previous administration.”

It added that the melted-and-poured requirement “will ensure that steel imports from Japan are actually produced there, which will help stem circumvention and allow workers in both countries an opportunity to succeed.”

After reaching the EU deal in October, the Biden administration has turned its attention to negotiating steel deals like the one announced on Monday with additional allies. The U.S. and U.K. last month started talks to address tariffs on both steel and aluminum and the problem of global overcapacity.

Source: Bloomberg

Source: Bloomberg